Cloud & AI - Scalable and Secure for You

Access a full portfolio of Compute, Storage, and AI services - optimized to work together seamlessly, backed by modern infrastructure, expert support, and end-to-end compliance.

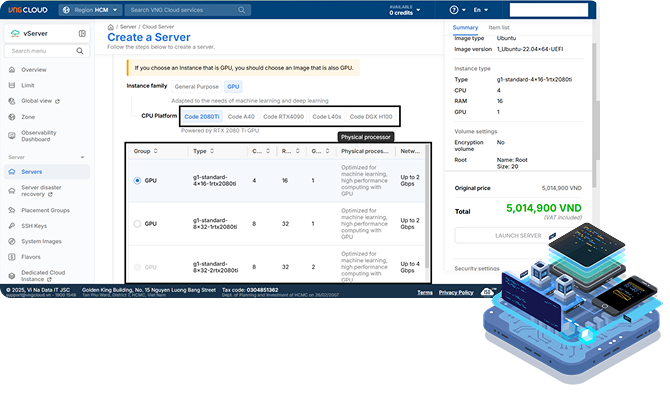

GPU Cloud

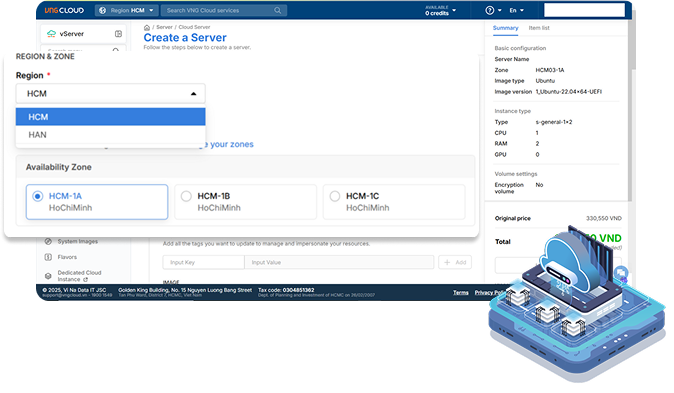

vServer

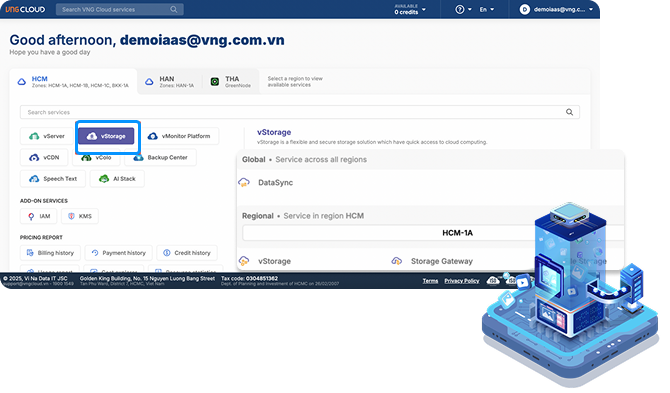

vStorage

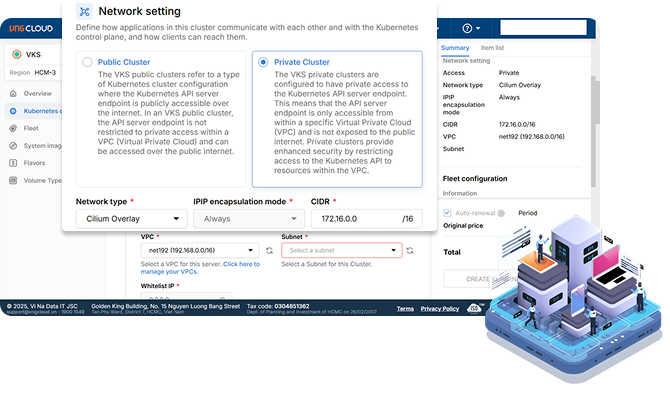

VKS (Kubernetes)

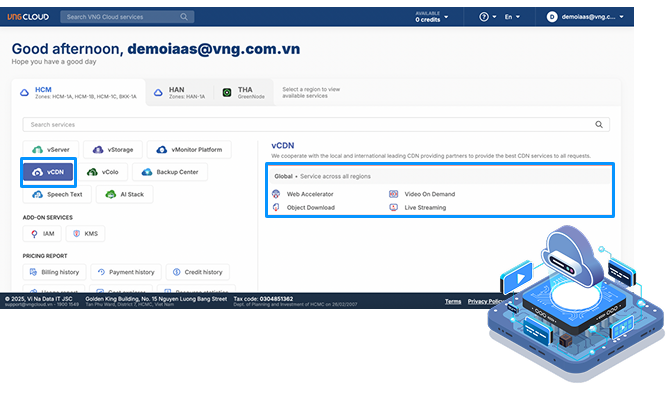

vCDN

Comprehensive Solutions Tailored for Every Industry

Whether you're launching new digital services, modernizing systems, or deploying AI applications, VNG Cloud delivers industry-grade performance, security, and in-depth technical support.

Financial services & Fintech

Ensure a highly available and resilient infrastructure for digital solutions and AI adoption

Retail & E-commerce

Edtech

SaaS & Tech startup

Everything You Need to Build, Run, and Scale with Cloud & AI

From infrastructure to compliance, AI training to app delivery—VNG Cloud gives you the tools, trust, and technical depth to move fast and securely.

Continuous Innovation that Keeps You Ahead

Deliver new capabilities faster with continuous updates, performance enhancements, and service expansion.

Modern AI at Scale, Built on NVIDIA Infrastructure

Power your AI models with NVIDIA® H100, L40S, A40 - optimized for both training and inference.

Managed Services & vMarketplace Ecosystem

Accelerate deployment with ready-to-use services and a growing ecosystem of AI, DevOps, and data tools.

Expert Support from Day 1 to Scale up

Work with cloud-certified architects and engineers—ready to support your mission from pilot to production 24/7.

Compliance-first Cloud, Built for Vietnam

Ensure data sovereignty and meet industry regulatory standards with PCI-DSS, ISO 27017/18, and local hosting.